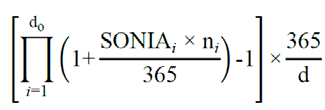

Daily SONIA compounded-in-arrears? Could the Bank of England have thought this through better?

For all the readers who think that to replace LIBOR with new RFR is a copy+paste job think about how a daily SONIA compounded-in-arrears index will bring basis risk into play when used for trade finance discounting.

Most trade finance products are based on discounting and hence the need a term rate to calculate forward discount cashflows is fundamental. Nearly, always the discount has to be applied and interest is charged front-loaded. This brings the inherent skew between using compounded SONIAs and the forward cash flow calculations.

So either the very structure of these products will have to undergo a change or the market will have to converge on a different kind of math to publish term rates. Mind you with all the math we are being forced to bring model risk and all the underlying assumptions of the models into the picture.

Further Reading:

Benchmark Rates: Compounded in Arrears, Term Rate and Further Alternatives